We all want to help those who want to stop smoking, but

Prop 56 is not what it appears to be.

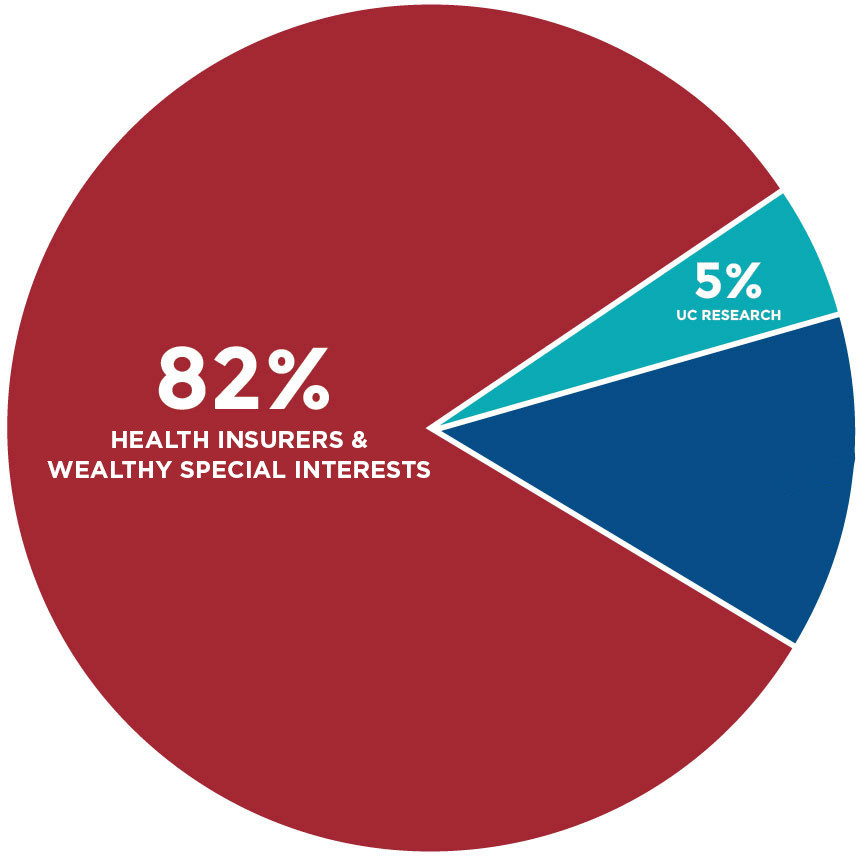

Prop 56 is a $1.4 billion “tax hike grab” by insurance companies and other wealthy special interests to dramatically increase their income by shortchanging schools and ignoring other pressing problems.

Source: Prop 56 spending formula for net funds after backfill and earmarked allocations

Note: Up to $147 million can be used for administrative costs—over 10% of the net revenues raised by the initiative.

Prop 56 Allocates

Just 13%

of New Tobacco Tax Money to

Help Smokers or Stop Kids from Starting

If we are going to tax smokers another $1.4 billion per year, more should be dedicated to helping them and keeping kids from starting.

Instead, most of the $1.4 billion in new taxes goes to health insurance companies and other wealthy special interests, instead of where it is needed.